The Value of Monitoring Credit Reports After Bankruptcy

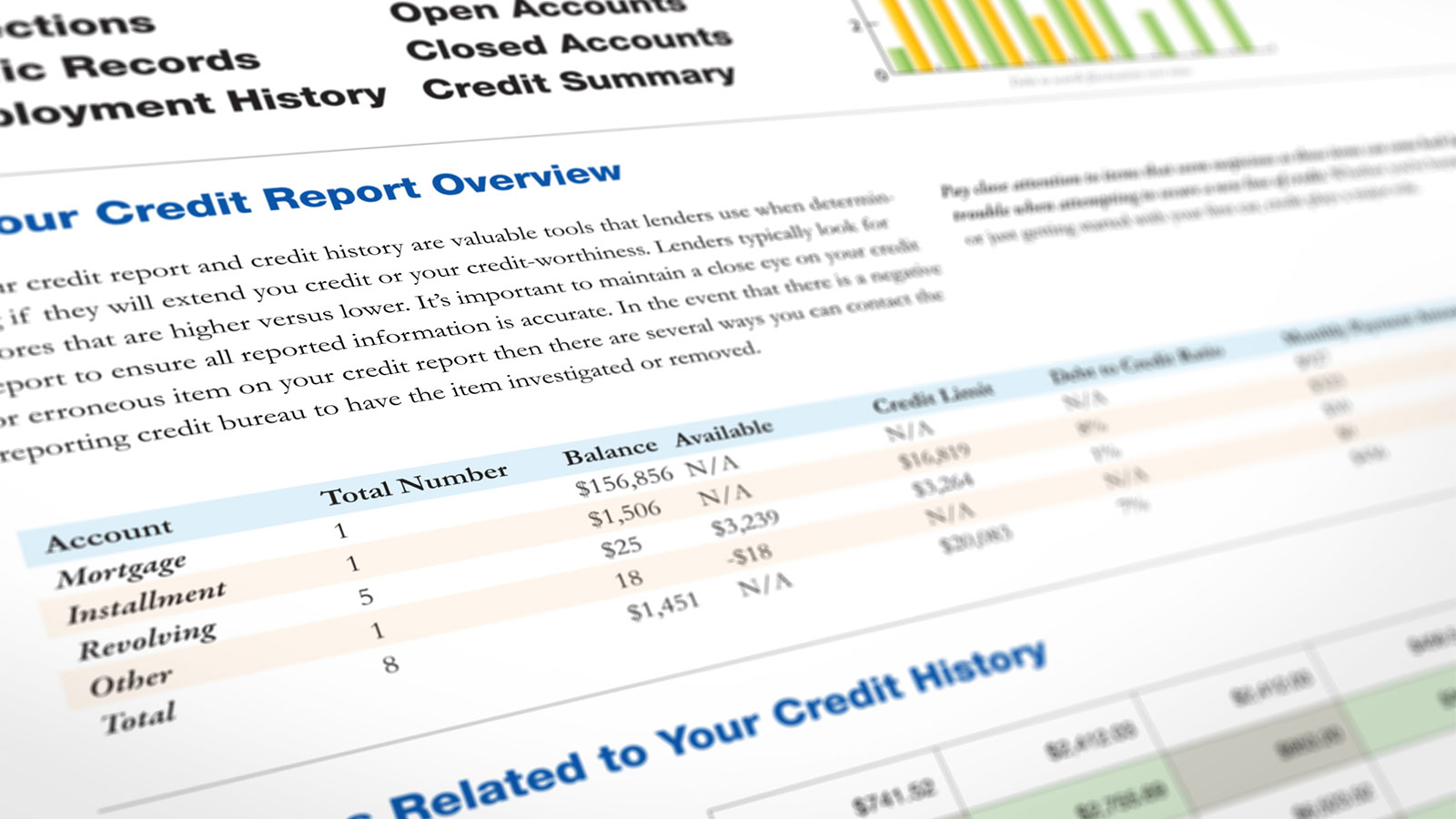

For individuals in Port Richey working toward financial recovery after bankruptcy, maintaining awareness of credit activity is an essential part of rebuilding stability. Credit reports play a central role in determining access to new credit, rental agreements, insurance rates, and even employment opportunities. Errors on these reports can slow progress or create unexpected challenges.

In 2025, consumers continue to have access to free weekly credit reports from each of the three major credit bureaus—Equifax, Experian, and TransUnion—through AnnualCreditReport.com. Originally introduced as a temporary measure during the pandemic, the Federal Trade Commission and the credit bureaus later made weekly access permanent. This allows individuals to review their reports throughout the year rather than relying on a single annual check.

Why Regular Credit Report Checks Matter

After completing a bankruptcy case, ensuring that debts are accurately reported is one of the most effective ways to monitor progress toward financial recovery. Credit reports should reflect the discharge of debts in Chapter 7 or the completion of a payment plan in Chapter 13. However, creditors do not always update these records promptly or correctly.

Errors in post-bankruptcy reporting often involve accounts that remain active, discharged balances, or inaccurate payment histories. In some cases, debts that no longer exist continue to appear as delinquent, creating an inaccurate picture of creditworthiness. These errors can lower credit scores, affect loan approvals, and create frustration for individuals who have worked diligently to rebuild.

By taking advantage of weekly access, Port Richey residents can catch and correct these inaccuracies before they cause harm. Regularly reviewing reports also helps detect signs of identity theft or unauthorized activity, which can be especially damaging during a financial recovery period.

What to Look for in Each Report

When reviewing a credit report, focus on the sections that list personal information, account history, and public records. Ensure that personal details such as name, address, and Social Security numbers are accurate and consistent across all three reports. Any discrepancies could signal a reporting error or an issue with identity verification.

For accounts included in bankruptcy, verify that they are marked with the correct notation, such as “discharged in bankruptcy” or “included in Chapter 13.” Balances should reflect zero, and no new late payments should appear after the bankruptcy filing date. Public record sections should accurately list the bankruptcy case, including the type (Chapter 7 or Chapter 13) and filing date.

Comparing all three reports is worthwhile because not every creditor reports to every bureau. This means an error might appear on one report but not on the others. Consistent review helps ensure that all reporting agencies reflect accurate, up-to-date information.

How to Dispute Errors

If you identify an error, the Fair Credit Reporting Act (FCRA) provides the right to dispute it. You can report the issue online, by mail, or by phone. When filing a dispute, provide supporting documentation such as discharge papers, account statements, or a copy of your bankruptcy order.

The credit bureau must investigate the dispute, typically within 30 days, and report the results in writing. The bureau must also send the corrected information to any entity that recently accessed your credit file. In some cases, if the bureau or creditor fails to correct verified inaccuracies, you may have legal grounds to pursue additional remedies under the FCRA.

The National Consumer Law Center’s Digital Library provides in-depth guidance on disputing credit reporting errors effectively and outlines the rights consumers have under federal law. Consulting these resources or seeking professional legal assistance can ensure that disputes are appropriately documented and resolved.

How a Bankruptcy Lawyer Can Help

While disputing credit report errors can be handled individually, some cases benefit from professional guidance, particularly when creditors repeatedly fail to correct inaccuracies or continue reporting discharged debts. A bankruptcy lawyer familiar with the Fair Credit Reporting Act can communicate directly with creditors and credit bureaus to enforce compliance.

For Port Richey residents, professional assistance may also help in determining whether post-bankruptcy errors stem from reporting negligence or potential violations of federal law. Taking prompt action protects your credit record and reinforces the fresh start that bankruptcy is designed to provide.

Rebuilding Credit Through Diligence

Access to free weekly credit reports in 2025 offers an invaluable opportunity for those recovering from bankruptcy. Regular monitoring fosters financial awareness and helps detect issues before they become obstacles. By accurately reporting all discharged debts, consumers can confidently rebuild their credit history and regain access to financial opportunities.

The process of rebuilding credit requires patience, but consistent review and timely disputes can accelerate progress. Taking advantage of the tools available today ensures that recovery after bankruptcy is supported by accurate and fair reporting.

For guidance on protecting your credit record and addressing post-bankruptcy reporting issues, contact Weller Legal Group, a Port Richey bankruptcy lawyer dedicated to helping clients rebuild financial security and ensure that their credit reports accurately reflect their hard-earned fresh start.